In the Eye of the Storm: 2023 Property Insurance Industry Trends

In the Eye of the Storm: 2023 Property Insurance Industry Trends

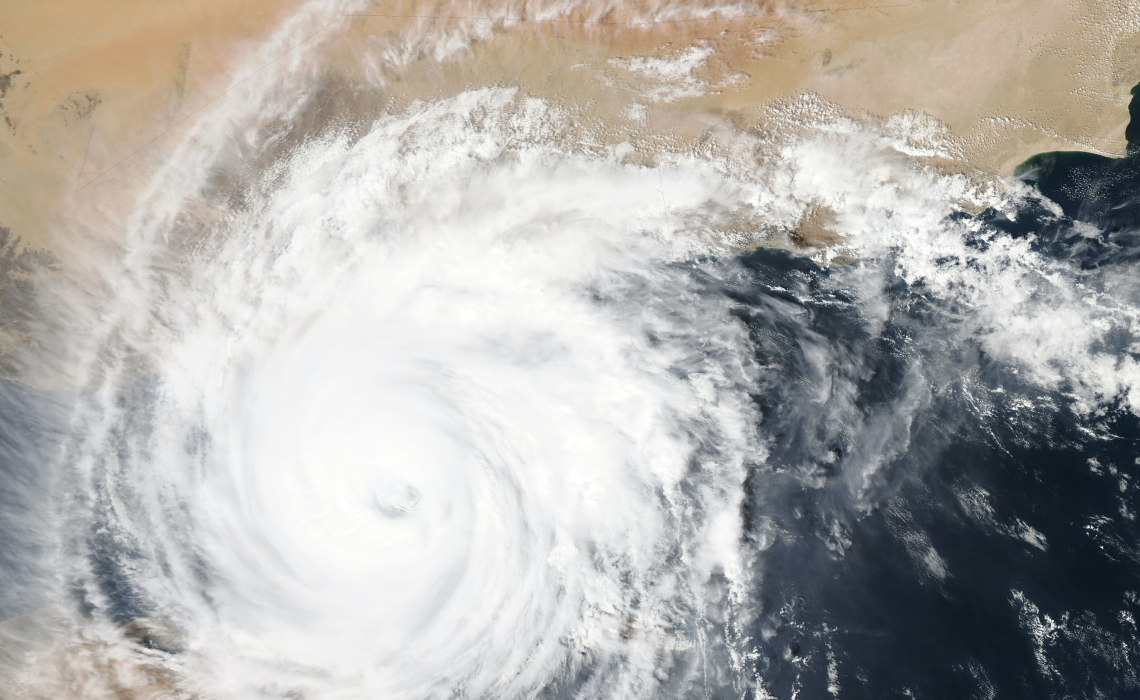

The Continued Impact of Climate Change

It seems like we have been discussing the impact of climate change on the property insurance industry for years and in many cases we have. 2022 showed us that this trend is not only going to slow down but most likely continue to be more impactful.

Record losses in Florida, California, Texas, and other states have insurers re-evaluating their underwriting strategies in these regions in hopes of returning to some level of profitability. Some carriers have already read the writing on the wall and stopped all operations in these areas while others have gone out of business completely. These mainly apply to retail home and auto insurers but could be an indicator that the impact of climate change and catastrophic events could begin to impact commercial property insurers.

With challenges come opportunities. The aforementioned states also happen to be among the most populous with extremely valuable real estate so the need for insurance will always be there. This presents an opportunity for underwriters to be more strategic and re-evaluate the way they look at commercial property. The opportunity for this lies in higher-quality data. There are multiple companies that specialize in this and provide new datasets previously not available in what they received in a traditional insurance application or renewal.

More recently, companies are delivering data by aggregating multiple third-party sources, leveraging satellite or aerial imagery, helping enhance commercial property owners’ own source documentation, and more. The real challenge now is for underwriters to understand what information is now available to them and how they can supplement their existing operations. Insurers that make strategic investments into improving the data their underwriters have access to will be able to make more informed decisions and have better results.

— Mike Winterle, Archipelago's Senior Product Marketing Manager

Interested in learning more about climate change and its impact on Insurance? Attend this presentation at RIMS in Atlanta on Tuesday, May 1, 2:45 PM - 3:45 PM.

“Climate Change and Catastrophic Property Loss: From Risk to Resilience” (Risk Modification and Loss Control, B405)

Get an overview of the changing nature of property risk and loss. Determine the role of climate-enhanced risk amidst the increasing frequency and severity of catastrophic property losses. See how climate-related losses impact the property insurance protection gap. Seek out opportunities to protect against catastrophic loss by enhancing your organization’s resilience.

Learning Objectives:

-

- Decipher the data on the changing nature of catastrophic property risk and the role of climate change.

- Distinguish when property insurance succeeds—and fails—regarding climate-related risk transfer and the protection gap.

- Outline steps for property owners and insurance companies to protect property against climate-enhanced risk.

See the full agenda at RIMS here.

Turning Data into Actionable Intelligence

The title of the award-winning film, “Everything Everywhere All at Once” brings to mind how we sometimes think about our property data, “Data Everywhere All at Once.” While complete, quality property risk data is a constant theme, the problem of data silos leads to the eventual realization that inputs from different systems need to be combined to drive decision-making. Organizing all of your information into structured data that’s easily integrated, for data-driven decisions, can be challenging when many disparate, but related sources need to be combined.

While many companies strive for a single “golden copy” of property-related data, the answer to this problem does not have a universal, one-size-fits-all solution. Instead, there are many options. Data may flow upstream to an asset management system or another source from which most of their data originates or downstream to their favorite property-related SaaS solution.

Other firms may choose to invest upfront in an enterprise-wide data warehouse solution, leveraging popular data cloud platforms like Snowflake. Yet others may opt to leverage the capabilities of Business Intelligence (BI) tools such as Tableau and Microsoft Power BI to blend and integrate their data for analytics.

For SaaS platforms, maximizing the number of platform touchpoints will be key to supporting customers’ mission for data-driven decisions. This means supporting as many data types and integrations as possible to minimize the number of data sources that need to be merged later. This may include connectivity to purpose-built platforms specializing in valuations, catastrophe models, and risk engineering among others.

Platforms should be willing to liberate data so it flows freely to and from related systems via APIs because as the renowned business author Seth Godin once said, “data is not useful until it becomes information.”

— Wilkie Ma, Archipelago's Technical Product Manager

Interested in learning more about system integrations? Attend this presentation at RIMS in Atlanta on Tuesday, May 2, 2:45 PM - 3:45 PM.

Brijesh Kumar, Founder & CEO, Klear.ai

Steven Robles, Asst. Chief Executive Officer, County of Los Angeles

“How the County of Los Angeles Uses Smart Software and Integrated Risk Management to Improve Fraud Detection, Audit and Financial Management” (Risk Modification and Loss Control, B405)

Hear how the County of Los Angeles is implementing advanced software tools and techniques by working closely with partners to overcome previously existing technical obstacles and organizational hurdles. Examine the process of adapting established risk management standards and frameworks to implement new approaches to tackling sophisticated fraud, abuse, and resourcing challenges. Take a look at their automated, end-to-end process that handles multiple auditing scenarios, including fraud, adjudication and quality. See how losses can be reduced through the use of artificial intelligence (AI) and machine learning (ML) to flag suspicious transactions and fraudulent claims. Review the improvement for personnel when workflow can be focused on those cases. Follow the processing improvements generated by quick feedback, better medical outcomes and prompt claims resolutions that boost employee morale.

Learning Objectives:

-

- Find new ways to reduce waste, fraud, and abuse in workers’ compensation claims.

- Determine how you can optimize bandwidth and current staff utilization.

- Set up means to monitor, explore and exploit opportunities for process improvement supported by data.

The Growing Focus on Profitability

The property insurance market has been a challenge for some time now. Increases are severe and more frequent. Whether the cause of or the result of, there are technology trends related to property insurance placements that are increasing in popularity. To offer the best terms and conditions, underwriters expect more data related to justify values and pricing.

New technologies make property data more accessible than before and changing climate diminishes the value of historic loss data.

Still, profitability never goes out of style. The property insurance market has been challenging for a long time and that isn’t a trend that will be changing anytime soon.

When it comes to underwriting and pricing risk, often the problem isn’t the absence of data, but rather that we don’t have the right information at the right time and in the optimal format. The uncertain economic environment is causing companies to focus on profitability. In insurance and risk transfer, that means a focus on those data points will have a material impact on pricing business profitably.

In addition to data that can impact rates, data organization can also drive profitability through efficiency. Brokers that can deliver the specific information underwriters need to make more strategic and profitable decisions.

— Michael Hansen, Archipelago's Client Services Executive

Interested in learning more about how quality data can make a difference? Attend this presentation at RIMS in Atlanta on Tuesday, May 2, 1:30 PM - 2:30 PM,

Robert Parisi, Munich Re Facultative & Corporate, MunichRe

Monica Shokrai, Head of Business Risk & Insurance, Google Cloud, Google, LLC

“Underwriting to Sustainability: Data-Driven Approach to Cyber Risk” (Cyber and Technology Risk, B401)

As cyber risks continue to evolve, underwriting must also transition to more than simply charging more money for a policy that passes muster. Seek ways to get beyond the pen-and-paper governance conversation and move inside the firewall. Consider the creation of a real database that can align a risk posture with exposure. Follow the way that cyber insurance can evolve to be more sustainable and utilize a more transparent process as we move to an ever-increasingly technology-dependent economy.

Learning Objectives:

-

- Identify flaws in current cyber insurance underwriting.

- Review methods of accessing a deeper understanding of applicant risk.

- Prepare to take steps to work with cyber underwriters to keep cyber insurance relevant and available.

Valuations: The Growing Need to Keep Building Values Current

Building valuations is a hotly contested topic directly impacting commercial property insurance renewals. Over the past several years, rising inflation, supply chain issues, construction material and labor cost increases have driven up building replacement costs. This cost escalation is normally not reflected in a current Statement of Values (SOV), resulting in a lack of agreement between insurers, brokers, and owners on the current estimate of replacement costs for buildings in need of property coverage.

Insurers contend that buildings are undervalued by 20% or more in commercial SOVs. In fact, multiple cost indices estimated the increase in construction costs between 2021 and 2022 alone to be in excess of 15%. Undervaluation results in insurers denying coverage, experiencing surprise shock claims, raising premiums (to account for lower values), and issuing more restrictive policy terms. Given the present escalating hard insurance market, timely and accurate estimation of building values is paramount for owners of commercial risks to acquire adequate coverage at a reasonable rate.

Solving the discrepancy in commercial property valuations will not be easy. Conducting physical inspections of every property in a large portfolio, although accurate, is not physically or economically viable at scale. Annually scaling up building values, by applying an inflation factor adjustment, does not address the problem suitable since it doesn’t factor in key cost drivers. The best way to solve the building valuation dilemma is through a combination of capturing relevant data and an efficient cost analysis framework to estimate the current replacement cost value (RCV) via an RCV calculation engine.

RCV calculation engines require a few input data parameters reflective of cost drivers (i.e. location, occupancy, construction) and can be used by owners and their brokers to efficiently estimate the overall accuracy of building values across an SOV. Where the values are noted to be appreciably divergent, normally due to undervaluation, the building values can be adjusted appropriately (i.e. physical appraisal, scale values, etc.). It’s important to note that insurers extensively use RCV calculation engines as part of their triage and underwriting process so in effect doing this analysis provides a window into how insurers will view building valuations prior to submission to the insurance market.

The more accurate and current building values the more accepted valuations will become over time by the property insurance market. Leveraging the highest quality and most complete information associated with a property and keeping the valuation current using an RCV engine will ensure better alignment with the current market conditions.

— Phil Legrone, Archipelago's Director of Product Strategy

Interested in hearing more about Valuations? Attend this presentation at RIMS in Atlanta on Tuesday, May 2, 2:45 PM - 3:45 PM.

Yohei Miyamoto, VP and West Region Manager for Property, Zurich Insurance

“When Double Is Not Fun: How to Come to Terms with the New Normal of the Property Insurance Market” (Trending Now, B409)

Property reinsurance treaty renewals include double-digit increases for many. It is time to accept that a hard market is the market. Neither costs, catastrophe frequency and severity, nor secondary perils suggest moderation anytime soon. Take steps to root your strategies, valuations, and coverage in reality and position your organization for resilience. Be aware of a key variable that property appraisals may omit. Get to know the dynamics and trends behind pricing and capacity. Differentiate between the immovable facts and the levers you can pull.

Learning Objectives:

-

- Distinguish the role of accurate valuations to ensure suitable limits without a deductible or retention shock.

- Identify key questions to ask a carrier at renewal time.

- Detect red flags and carrier challenges so you can work out fixes and risk transfer alternatives for your organization.

Check out the full agenda for the RIMS 2023 RISKWORLD Conference here. We'll see you there!

Share this

You May Also Like

These Related Stories

Risk Analysis Lessons From Hurricane Ian

Into the Looking Glass: 2022 Risk & Insurance Trend Predictions