Why You Should Pay Closer Attention to Roof Age for Commercial Properties

Why You Should Pay Closer Attention to Roof Age for Commercial Properties

A key factor that often tops other property attributes in commercial property risk is the roof, and specifically, its age. Roof age is especially crucial in areas prone to high winds and hail, where the structural integrity of the roof can have a significant impact on the vulnerability of the roof system. Failing to adequately measure and account for the roof age can drive unwanted impacts to coverage and premium values for property owners, their brokers, and risk management teams. Let’s discuss the top reasons why roof age is so important in commercial property insurance and how you can address data gaps for roof age in any property schedule.

1. Missing or Misleading Roof Ages Will Cost You

Bad or missing data for roof age is nothing new, but it can have a significant impact on insurance premiums and claims payouts. Based on a report by Verisk, there is approximately $1.31B in annual premium leakage due to miscalculated or missing roof age, and more than 25% of roofs are misclassified as being younger than 15 years old. Typically, a roof is covered for just 20 years, which is less than the lifespan of most commercial roofing systems, so it’s easy to see why interests aren’t intrinsically aligned between owner and insurer.

So what happens if a loss event occurs and the roof age was wrong or misleading? Property owners are at risk of having their commercial roof damage claims denied without an accurate measure of roof age. In the context of risk transfer, they’re also more likely to need to pay more in premiums upfront on missing or flagged roof age data points because the underwriters will tend to quote more conservatively in instances where the evidence isn’t clear to prove otherwise.

2. Structural Integrity and Wind Resistance Can Be Implied by Roof Age

The roof age data indicated in SOVs signals different levels of structural integrity for each building, and underwriters can infer a lot based on this attribute alone. While they might not have the time, energy, resources, or desire to examine each property fully, underwriters understand the basic risk principles. They know that adequate sheathing thickness, fastener spacing, and fastener type are vital to the roof and building performance during high-wind events.

Underwriters also know and might assume that older roofs may have wear and tear that compromises their ability to withstand high winds, and they closely evaluate the wind resistance capabilities of roofs. Though failures occur in different ways, they can compound to generate significant losses. Even a single roof sheathing panel blowing free due to fastener issues in a hurricane or tornado can be catastrophic. High winds can also cause the roof flashing to separate from the roof material, damage protective roof flashing, lead to an uplift, or create a significant opening in a roof membrane.

3. Material Deterioration Is Expected in Older Roofs

Different roofing materials age differently, so there is pressure to put on the roof age data points if roof materials are either assumed or known. Understanding the lifespan and deterioration patterns of roofing materials is crucial for risk modeling. Many common sealing and binding agents in roof membranes are highly susceptible to storm damage. The expected degradation of sealing and bind agents coupled with a known older roof age will generate a higher vulnerability expectation.

While it is understood that all roofing materials degrade over time, the technical study of real-world performance is lacking. For example, past research by Southeast Region Research Initiative (SERRI) reports that the impact of degradation of asphalt shingles on performance during high wind events remains elusive. Therefore, having an accurate measure of roof age and a general understanding of material degradation remains the best indicator of material performance for risk buyers.

4. Different Roof Ages Align with Different Building Codes

Roofing upgrades should consider the building code adopted in the area. The building code changes periodically and often serve to make the building more resilient. Older roof systems may not be compliant as the code requires more resilience to high winds, heavy rain, snow loads, and hail. Based on the roof age study by IBHS, shingle roofs installed after the adoption of the 2000 International Building Code experienced much less wind damage during Hurricane Ike when compared to buildings with older roofs designed to pre-2000 building codes.

Prior to May 2022, Homeowners in Florida could be denied insurance coverage solely based on their roof age. Companies are now blocked from denying coverage in roofs that are less than 15 years old. For roofs that have a service life greater than five years, coverage cannot be rejected. Additionally, if the roof is damaged more than 25% and the roof was designed in accordance with at least the 2007 Florida Building Code, the property owner can choose to repair rather than replace the full roof. Therefore, to ensure continued insurance coverage and costly replacement, understanding and documenting the roof's age becomes imperative.

5. Catastrophe Models will Use Roof Age to Help Determine Average Annual Loss

The increased risks associated with roof age are not just assumed but also modeled objectively. Risk modeling agencies like RMS and Verisk use sophisticated models to assess potential losses from natural disasters, including wind events. Roof age plays a crucial role in these models and is a key factor in calculating the Average Annual Loss (AAL). Older roofs may contribute to a higher AAL due to increased susceptibility to wind-related damages. Insurance carriers use this metric to estimate the financial impact of potential claims over time, making roof age a pivotal aspect of risk assessment.

A previous study by RMS has found the impact of roof age alone in residential properties correlated to up to a 50% increase in losses in areas of the country synonymous with hurricanes and high winds. For structures with a high baseline AAL, this increase can result in significant premiums. As high wind events and hurricanes continue to become more frequent due to climate change, understanding the impact of the roof age on AAL from the perspective of property owners and brokers is imperative.

Upgrades can offset some model modifiers. Property owners investing capital expenditures in roof upgrades with modern, wind-resistant materials can significantly reduce their risk profile by communicating these updates alongside their brokers in renewal submissions and model files. As expected, insurance carriers often incentivize such proactive measures by offering lower premiums to properties with updated roofing systems due to overall lower perceived and modeled risks.

Come Out on Top

If you or your clients have properties with high wind exposures, then it would be prudent to pay more attention to the attribute of roof age in the SOV. Being armed with an understanding of the impact of roof age on risk modeling and AALs can help you make informed decisions to mitigate risks, enhance structural integrity, and secure favorable terms with insurance carriers with each renewal. Embracing modern roofing materials and prioritizing regular maintenance can be instrumental in navigating the winds of insurance challenges.

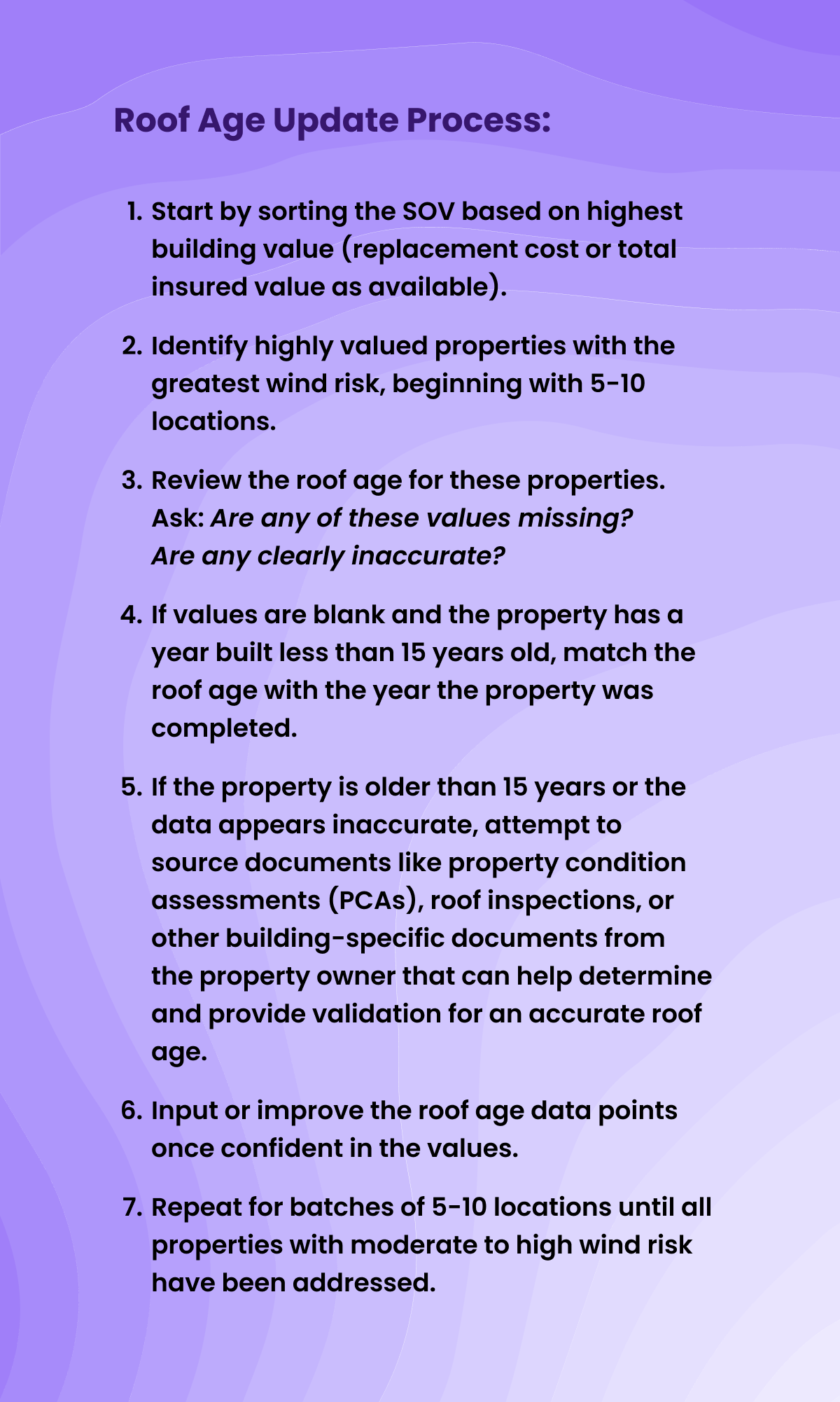

Roof age is one of hundreds of property attributes for any large property schedule that can be managed more efficiently using Archipelago. Using the example of improving roof age gaps from above, service teams can utilize Archipelago SOV Manager and PreCheck applications to prioritize high wind risk properties and source accurate roof ages through uploaded source documents. Learn more by visiting the SOV Manager webpage and request a personalized demo today.

Share this

You May Also Like

These Related Stories

White Paper: Demystifying How Your Property Data Drives Your Insurance Outcomes

Commercial Property Data: A Guide for Insurance Brokers