Insurance Policy Management Software Reimagined for Brokers

Insurance Policy Management Software Reimagined for Brokers

December 04, 2025

14

min read

Insurance Data Analytics: Turning Chaos into Brokerage Growth

Insurance Data Analytics: Turning Chaos into Brokerage Growth

November 25, 2025

11

min read

Insurance Industry Challenges Brokers Can’t Afford to Ignore

Insurance Industry Challenges Brokers Can’t Afford to Ignore

November 18, 2025

12

min read

Property Condition Assessment Reports: Broker Roadmaps

Property Condition Assessment Reports: Broker Roadmaps

November 05, 2025

12

min read

The Data Advantage of MGAs: Winning Markets with Archipelago

The Data Advantage of MGAs: Winning Markets with Archipelago

October 30, 2025

10

min read

Geospatial Data Analytics: A Complete Guide for Brokers

Geospatial Data Analytics: A Complete Guide for Brokers

October 22, 2025

10

min read

The Power of Climate Risk Modeling in P&C Market

The Power of Climate Risk Modeling in P&C Market

October 01, 2025

11

min read

Insurance Risk Management Software: Your Complete Guide

Insurance Risk Management Software: Your Complete Guide

September 29, 2025

11

min read

Risk Management in Insurance: A Manual for Brokers

Risk Management in Insurance: A Manual for Brokers

September 02, 2025

10

min read

Insurance Technology Trends: Your Action Guide + Checklist

Insurance Technology Trends: Your Action Guide + Checklist

August 29, 2025

7

min read

Insurance Risk Assessment: Tools and Strategies for Brokers

Insurance Risk Assessment: Tools and Strategies for Brokers

August 12, 2025

10

min read

Insurance Document Automation with Archipelago's AI Agent

Insurance Document Automation with Archipelago's AI Agent

August 04, 2025

10

min read

Types of Risk in Insurance

Types of Risk in Insurance

July 28, 2025

10

min read

Insurance Automation Software: Eliminate Costly Manual Risks

Insurance Automation Software: Eliminate Costly Manual Risks

July 18, 2025

7

min read

5 Ways Automated Insurance Solutions Boost Productivity

5 Ways Automated Insurance Solutions Boost Productivity

July 18, 2025

7

min read

Above-Normal Hurricane Season, AI’s Critical Role in Insurance

Above-Normal Hurricane Season, AI’s Critical Role in Insurance

July 14, 2025

3

min read

FNOL: A Critical Step in a Data-Driven Risk Strategy

FNOL: A Critical Step in a Data-Driven Risk Strategy

July 01, 2025

7

min read

A Guide to Property and Casualty Insurance Software

A Guide to Property and Casualty Insurance Software

July 01, 2025

9

min read

How to Improve Your Loss Run Report Process with AI

How to Improve Your Loss Run Report Process with AI

May 19, 2025

7

min read

The Business Income Coverage Form: An Essential Protection Guide

The Business Income Coverage Form: An Essential Protection Guide

May 19, 2025

6

min read

Casualty Rates Up 8%, 1 in 3 Buildings Hit by Catastrophes in Last 5 Years

Casualty Rates Up 8%, 1 in 3 Buildings Hit by Catastrophes in Last 5 Years

May 12, 2025

3

min read

AI for Insurance Agents: How to Streamline Your Workflow

AI for Insurance Agents: How to Streamline Your Workflow

May 09, 2025

7

min read

Turning Mitigation into Action: FortressFire’s Wildfire Modeling Insights

Turning Mitigation into Action: FortressFire’s Wildfire Modeling Insights

April 30, 2025

25

min read

Your Blueprint for Stress Testing in Risk Management in 2025

Your Blueprint for Stress Testing in Risk Management in 2025

April 24, 2025

6

min read

Tariffs, Legal Battles, and Premium Spikes—The April Surge Brokers Can't Ignore

Tariffs, Legal Battles, and Premium Spikes—The April Surge Brokers Can't Ignore

April 24, 2025

3

min read

Community Solutions & Market Shifts: Wildfire Risk with EPIC's Patrick Gallagher & Mike McNulty

Community Solutions & Market Shifts: Wildfire Risk with EPIC's Patrick Gallagher & Mike McNulty

April 17, 2025

21

min read

Reinsurance Reaches $715 Billion: Navigating the $115 Billion Alternative Capital Boom

Reinsurance Reaches $715 Billion: Navigating the $115 Billion Alternative Capital Boom

April 07, 2025

3

min read

Top 7 Risk Management Best Practices for Insurance Brokers

Top 7 Risk Management Best Practices for Insurance Brokers

April 07, 2025

6

min read

Firsthand Wildfire Recon with Erin Ashley, Ph.D.

Firsthand Wildfire Recon with Erin Ashley, Ph.D.

April 03, 2025

24

min read

Insurance Agency Management Systems: Accuracy Made Simple

Insurance Agency Management Systems: Accuracy Made Simple

March 26, 2025

6

min read

38% Rate Hikes, AI & Drones, and a Florida Surprise: The P&C Shake-Up You Can’t Ignore

38% Rate Hikes, AI & Drones, and a Florida Surprise: The P&C Shake-Up You Can’t Ignore

March 24, 2025

3

min read

Your Guide to Must-Visit Sessions at the RIMS Conference 2025

Your Guide to Must-Visit Sessions at the RIMS Conference 2025

March 20, 2025

7

min read

Advanced Climate Risk Management for 2025 & Beyond

Advanced Climate Risk Management for 2025 & Beyond

March 10, 2025

10

min read

Property Insurance Trends: Key Changes in 2025

Property Insurance Trends: Key Changes in 2025

February 24, 2025

7

min read

Key Insurance Loss Control Techniques for Property Brokers

Key Insurance Loss Control Techniques for Property Brokers

February 24, 2025

7

min read

Your Guide to RIMS 2025: Navigate Chicago Like a Pro

Your Guide to RIMS 2025: Navigate Chicago Like a Pro

February 04, 2025

10

min read

Fire Hazard Maps and Their Critical Role in Wildfire Protection

Fire Hazard Maps and Their Critical Role in Wildfire Protection

February 01, 2025

7

min read

Insurance Geocoding: Elevate Your Property Risk Assessment

Insurance Geocoding: Elevate Your Property Risk Assessment

January 16, 2025

7

min read

PML Insurance: Understanding Probable Maximum Loss

PML Insurance: Understanding Probable Maximum Loss

January 09, 2025

7

min read

Roof Inspection for Insurance: What Brokers Need to Know

Roof Inspection for Insurance: What Brokers Need to Know

January 07, 2025

7

min read

Insurance to Value: A Comprehensive Guide for Property Management

Insurance to Value: A Comprehensive Guide for Property Management

December 13, 2024

7

min read

AAL Insurance: Understanding Average Annual Loss in Property

AAL Insurance: Understanding Average Annual Loss in Property

December 10, 2024

6

min read

TIV Insurance: Understanding Total Insurable Value in Property

TIV Insurance: Understanding Total Insurable Value in Property

November 21, 2024

7

min read

Using a Risk Management Information System to Empower Brokers

Using a Risk Management Information System to Empower Brokers

November 21, 2024

8

min read

Flood Zone Determination: Essential for Accurate Insurance

Flood Zone Determination: Essential for Accurate Insurance

November 01, 2024

7

min read

Natural Hazard Disclosure Report: A Critical Tool for Property Insurance

Natural Hazard Disclosure Report: A Critical Tool for Property Insurance

October 21, 2024

8

min read

Property Data Report: Everything Insurance Brokers Need to Know

Property Data Report: Everything Insurance Brokers Need to Know

October 16, 2024

7

min read

SOV Insurance: Streamlining Property Data Management

SOV Insurance: Streamlining Property Data Management

October 07, 2024

9

min read

Alliant's Mark Goode on the Evolving Landscape of Public Entity Insurance

Alliant's Mark Goode on the Evolving Landscape of Public Entity Insurance

October 01, 2024

17

min read

5 SOV Insurance Broker Tools to Evaluate in 2025 and Beyond

5 SOV Insurance Broker Tools to Evaluate in 2025 and Beyond

September 25, 2024

9

min read

Property Risk Management: Safeguarding Assets with Data

Property Risk Management: Safeguarding Assets with Data

September 23, 2024

8

min read

How Enterprise Risk Management Tools Help Insurance Brokers

How Enterprise Risk Management Tools Help Insurance Brokers

September 13, 2024

8

min read

Commercial Property Data: A Guide for Insurance Brokers

Commercial Property Data: A Guide for Insurance Brokers

September 11, 2024

8

min read

Go for Gold: Help Your Team Achieve Peak Performance with Property Hub

Go for Gold: Help Your Team Achieve Peak Performance with Property Hub

August 19, 2024

3

min read

COPE Data: Enhancing Risk Assessment for Insurance

COPE Data: Enhancing Risk Assessment for Insurance

August 19, 2024

9

min read

Catastrophe Modeling: Essential Insights for Risk Management

Catastrophe Modeling: Essential Insights for Risk Management

August 19, 2024

8

min read

Bridging Global Insurance Gaps: WBN's Olga Collins on the Future of Broker Networks

Bridging Global Insurance Gaps: WBN's Olga Collins on the Future of Broker Networks

August 07, 2024

18

min read

Archipelago Launches AI Tools to Help Broker Leaders Improve How Their Teams Prepare Submissions

Archipelago Launches AI Tools to Help Broker Leaders Improve How Their Teams Prepare Submissions

August 06, 2024

2

min read

Statement of Values: The Broker's Tool for Client Success

Statement of Values: The Broker's Tool for Client Success

August 01, 2024

7

min read

Pre-Check: Your SOV Data Health Inspection

Pre-Check: Your SOV Data Health Inspection

July 26, 2024

4

min read

Why Insurance Brokers Should Invite Their Teams and Clients to Archipelago

Why Insurance Brokers Should Invite Their Teams and Clients to Archipelago

June 20, 2024

3

min read

Gallagher's Alexandra Glickman on the Role of People in the Future of Insurance

Gallagher's Alexandra Glickman on the Role of People in the Future of Insurance

June 18, 2024

23

min read

Revolutionizing Risk Management with AI and Technology: A Conversation with CoreLogic's Garret Gray

Revolutionizing Risk Management with AI and Technology: A Conversation with CoreLogic's Garret Gray

May 14, 2024

19

min read

Leading with Data: How Alliant's Alex Littlejohn is Transforming Insurance Solutions

Leading with Data: How Alliant's Alex Littlejohn is Transforming Insurance Solutions

April 09, 2024

22

min read

Mitigating Severe Convective Storm Damage: Lessons from 2023

Mitigating Severe Convective Storm Damage: Lessons from 2023

March 07, 2024

5

min read

Verisk's Rob Newbold on Shaping the Future of CAT Modeling

Verisk's Rob Newbold on Shaping the Future of CAT Modeling

February 27, 2024

18

min read

Aon's Joe Peiser on Driving Differentiation through Data & Analytics

Aon's Joe Peiser on Driving Differentiation through Data & Analytics

February 15, 2024

16

min read

Why You Should Pay Closer Attention to Roof Age for Commercial Properties

Why You Should Pay Closer Attention to Roof Age for Commercial Properties

January 30, 2024

5

min read

2023 Property Risk Management Report

2023 Property Risk Management Report

August 24, 2023

1

min read

Educating Your Organization on Becoming More Resilient to Climate Risks

Educating Your Organization on Becoming More Resilient to Climate Risks

July 31, 2023

2

min read

Wildfires Growing Wilder

Wildfires Growing Wilder

July 27, 2023

3

min read

Importance of Valuations

Importance of Valuations

April 24, 2023

3

min read

In the Eye of the Storm: 2023 Property Insurance Industry Trends

In the Eye of the Storm: 2023 Property Insurance Industry Trends

April 24, 2023

8

min read

Insurance Journal Recap: What Ancient Roman Firefighting Can Teach Us About the State of Commercial Insurance Today

Insurance Journal Recap: What Ancient Roman Firefighting Can Teach Us About the State of Commercial Insurance Today

March 28, 2023

1

min read

Risk Analysis Lessons From Hurricane Ian

Risk Analysis Lessons From Hurricane Ian

March 10, 2023

1

min read

Risk Management 101: The Importance of Emergency Action Plans

Risk Management 101: The Importance of Emergency Action Plans

February 09, 2023

3

min read

Archipelago Demonstrates Commitment to Security by Completing SOC 2 Type I Attestation

Archipelago Demonstrates Commitment to Security by Completing SOC 2 Type I Attestation

February 01, 2023

1

min read

How Can Transparency Transform the Property Insurance Landscape?

How Can Transparency Transform the Property Insurance Landscape?

January 24, 2023

3

min read

Perspectives on Navigating Risk

Perspectives on Navigating Risk

January 11, 2023

1

min read

Curing the Property Pain Chain

Curing the Property Pain Chain

September 28, 2022

31

min read

2022 Property Risk Management Report

2022 Property Risk Management Report

August 09, 2022

1

min read

Modernizing Property Risk Data

Modernizing Property Risk Data

July 12, 2022

3

min read

These Walls Can Talk

These Walls Can Talk

July 05, 2022

5

min read

Taming Catastrophe Models

Taming Catastrophe Models

June 28, 2022

3

min read

Work Smarter, Not Harder With Archipelago AI

Work Smarter, Not Harder With Archipelago AI

June 22, 2022

2

min read

Building Resilience for a Changing Climate

Building Resilience for a Changing Climate

June 14, 2022

3

min read

Where Property Insurance Buyers Are Headed: A Paradigm Shift

Where Property Insurance Buyers Are Headed: A Paradigm Shift

May 31, 2022

5

min read

12 Qs with Steven Sachs, SWS Risk Management Advisor, LLC

12 Qs with Steven Sachs, SWS Risk Management Advisor, LLC

May 23, 2022

6

min read

Recap: Back From RIMS Webinar

Recap: Back From RIMS Webinar

May 06, 2022

2

min read

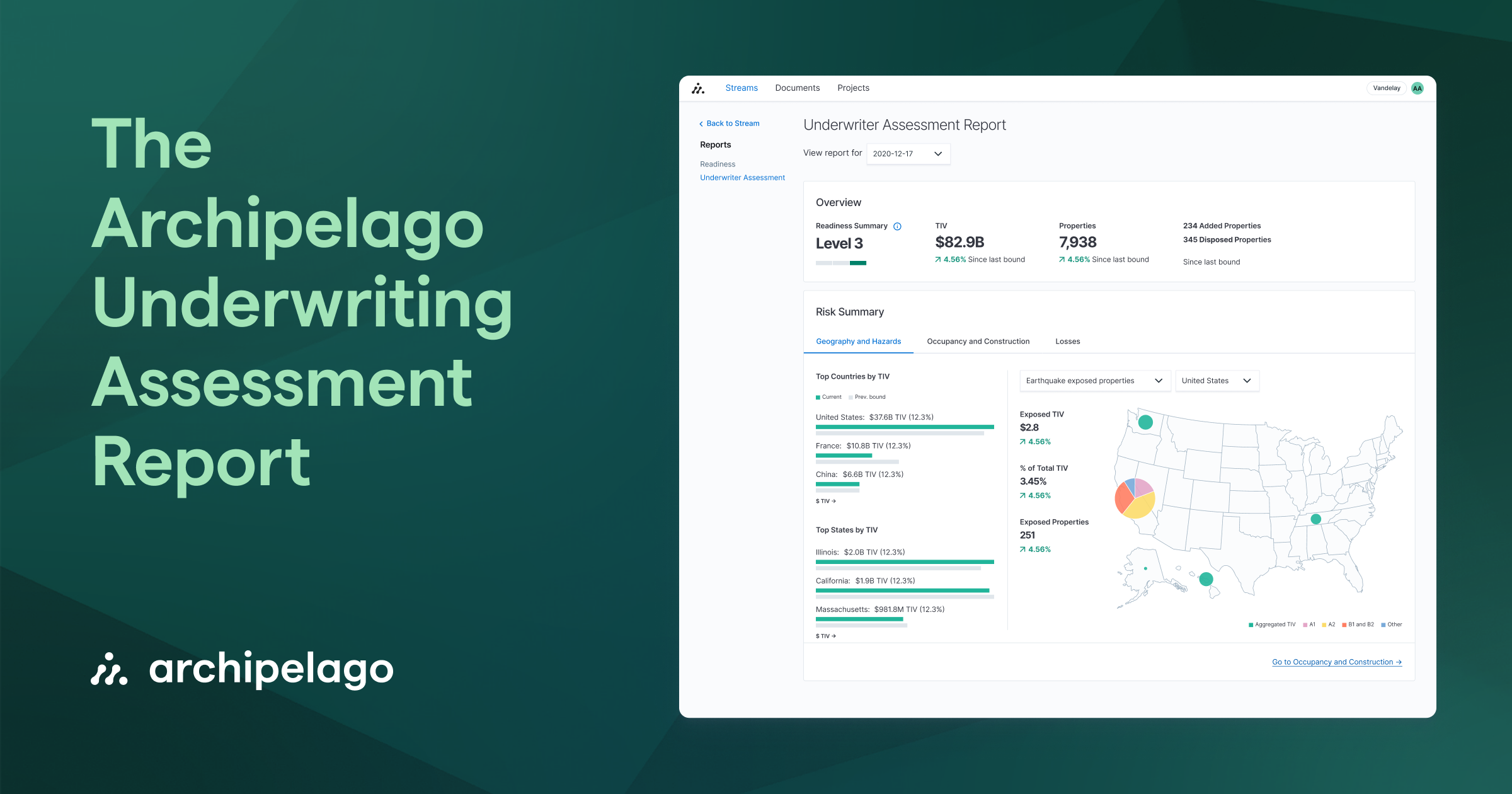

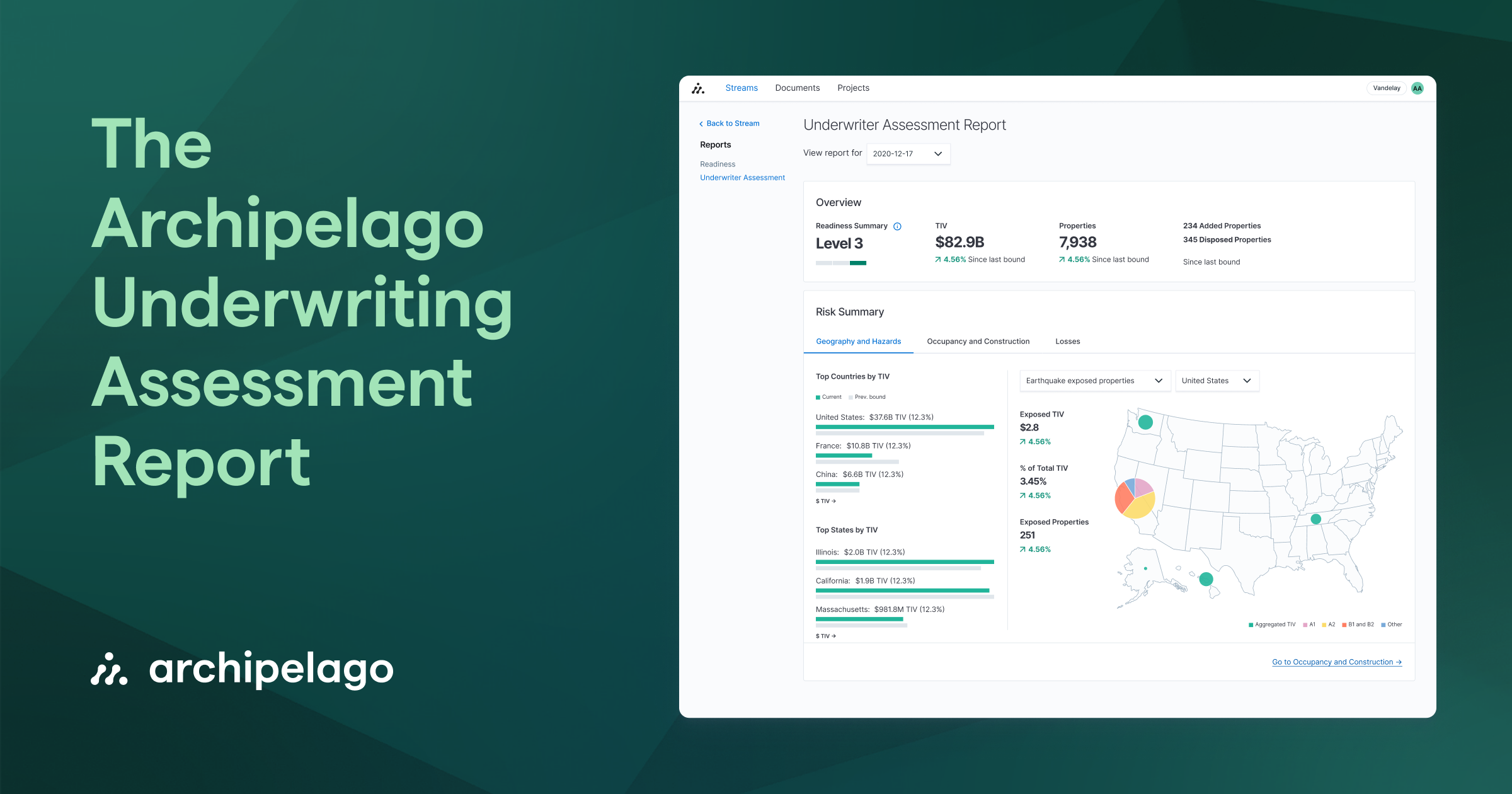

The Archipelago Underwriting Assessment Report

The Archipelago Underwriting Assessment Report

April 22, 2022

3

min read

10 Pillars of Property Insurance for Commercial Real Estate Owners

10 Pillars of Property Insurance for Commercial Real Estate Owners

April 15, 2022

2

min read

Big Changes Ahead For Flood Insurance

Big Changes Ahead For Flood Insurance

March 16, 2022

2

min read

The Archipelago Readiness Report

The Archipelago Readiness Report

February 04, 2022

4

min read

On Common Ground: The Journey to $7T of TIV and Beyond

On Common Ground: The Journey to $7T of TIV and Beyond

January 24, 2022

2

min read

Into the Looking Glass: 2022 Risk & Insurance Trend Predictions

Into the Looking Glass: 2022 Risk & Insurance Trend Predictions

January 05, 2022

9

min read

Archipelago's Top 5 Articles of 2021: Risk & Insurance Insights

Archipelago's Top 5 Articles of 2021: Risk & Insurance Insights

December 09, 2021

1

min read

12 Qs with Jackson Slavik, Former Head of Starwood Capital

12 Qs with Jackson Slavik, Former Head of Starwood Capital

December 06, 2021

3

min read

The Imperative of Ensuring Resiliency - Advisen 2021 Property Insights

The Imperative of Ensuring Resiliency - Advisen 2021 Property Insights

December 03, 2021

1

min read

Blueprint 2021: Fireside Interview On The Untapped Proptech Category

Blueprint 2021: Fireside Interview On The Untapped Proptech Category

November 12, 2021

1

min read

Advisen and Archipelago 2021 Property Risk Management Report

Advisen and Archipelago 2021 Property Risk Management Report

November 09, 2021

1

min read

Innovation in the Large Commercial Property Insurance Business

Innovation in the Large Commercial Property Insurance Business

November 08, 2021

4

min read

Power of Data-Driven Differentiation in Risk and Insurance

Power of Data-Driven Differentiation in Risk and Insurance

November 08, 2021

3

min read

What Went Wrong in Surfside? A Risk Engineer’s Perspective

What Went Wrong in Surfside? A Risk Engineer’s Perspective

October 20, 2021

9

min read

12 Qs with Kate Stillwell, Founder & CEO of Jumpstart Insurance

12 Qs with Kate Stillwell, Founder & CEO of Jumpstart Insurance

October 20, 2021

4

min read

12 Qs with Christine Sullivan, SVP, Risk Control Director at Sompo

12 Qs with Christine Sullivan, SVP, Risk Control Director at Sompo

October 18, 2021

9

min read

Harnessing Your Own Property Data to Improve Risk & Insurance with RIMS & Blackstone - On-demand Webinar

Harnessing Your Own Property Data to Improve Risk & Insurance with RIMS & Blackstone - On-demand Webinar

September 14, 2021

2

min read

12 Qs with Seraina Macia, CEO & Co-Founder of Joyn Insurance

12 Qs with Seraina Macia, CEO & Co-Founder of Joyn Insurance

September 09, 2021

2

min read

12 Qs with Justin Levine, Co-Founder & CEO at Shepherd

12 Qs with Justin Levine, Co-Founder & CEO at Shepherd

September 09, 2021

5

min read

RIMSLIVE: Property Data Must-Haves to Optimize Insurance Outcomes

RIMSLIVE: Property Data Must-Haves to Optimize Insurance Outcomes

August 31, 2021

3

min read

There’s A Way To Stop Climate Change Risk Pushing Up Premiums

There’s A Way To Stop Climate Change Risk Pushing Up Premiums

August 20, 2021

4

min read

White Paper: Demystifying How Your Property Data Drives Your Insurance Outcomes

White Paper: Demystifying How Your Property Data Drives Your Insurance Outcomes

August 16, 2021

1

min read

12 Qs with Kais Al-Rawi, AIA, Senior Associate at Walter P Moore

12 Qs with Kais Al-Rawi, AIA, Senior Associate at Walter P Moore

August 10, 2021

3

min read

Beat the Renewal Rush Using Archipelago to Manage Properties

Beat the Renewal Rush Using Archipelago to Manage Properties

August 04, 2021

4

min read

Accelerating CRE’s Digital Shift With Risk Management & Insurance

Accelerating CRE’s Digital Shift With Risk Management & Insurance

July 26, 2021

3

min read

Connecting Risk & Capital for Better Protection: Blueprint Interview

Connecting Risk & Capital for Better Protection: Blueprint Interview

July 19, 2021

9

min read

Moving Upstream: Digitizing & Standardizing Customer Data at Source

Moving Upstream: Digitizing & Standardizing Customer Data at Source

July 15, 2021

6

min read

12 Qs with Matthew Grant, Partner at InsTech London

12 Qs with Matthew Grant, Partner at InsTech London

July 13, 2021

4

min read

Rise of Parametric Insurance in an Increasingly Disaster-prone World

Rise of Parametric Insurance in an Increasingly Disaster-prone World

June 24, 2021

2

min read

12 Qs with Gary Kaplan, President of Construction at AXA XL

12 Qs with Gary Kaplan, President of Construction at AXA XL

June 22, 2021

5

min read

12 Qs with Ronald T. Eguchi, CEO and Co-Founder of ImageCat

12 Qs with Ronald T. Eguchi, CEO and Co-Founder of ImageCat

June 10, 2021

3

min read

12 Qs with Victor J. Sordillo, EVP, Global Director Risk Control at Sompo

12 Qs with Victor J. Sordillo, EVP, Global Director Risk Control at Sompo

May 26, 2021

6

min read

12 Qs with Roger Platt, SVP, Strategic Partnerships & Growth at GBCI

12 Qs with Roger Platt, SVP, Strategic Partnerships & Growth at GBCI

April 29, 2021

3

min read

12 Qs with Jeff Cohen, SVP at Zywave and former President of Advisen

12 Qs with Jeff Cohen, SVP at Zywave and former President of Advisen

April 29, 2021

5

min read

12 Qs with Jack Gibson, President & CEO at IRMI and CEO of WebCE

12 Qs with Jack Gibson, President & CEO at IRMI and CEO of WebCE

April 29, 2021

4

min read

Accelerating Impact: Announcing Our Series B Venture Funding

Accelerating Impact: Announcing Our Series B Venture Funding

April 20, 2021

3

min read

Using Data to Drive Value to Our Stakeholders

Using Data to Drive Value to Our Stakeholders

April 16, 2021

1

min read

Using Data to Differentiate Our Assets

Using Data to Differentiate Our Assets

April 16, 2021

1

min read

Using Applied ML to Solve Central Problems in the Insurance Industry

Using Applied ML to Solve Central Problems in the Insurance Industry

April 16, 2021

1

min read

Use Your Data to Get Proactive

Use Your Data to Get Proactive

April 16, 2021

1

min read

12 Qs with Tim Wright, Senior Advisor & Director, Archipelago

12 Qs with Tim Wright, Senior Advisor & Director, Archipelago

April 16, 2021

3

min read

Improving the Commercial Insurance Sector Needs an Inside-Out Approach

Improving the Commercial Insurance Sector Needs an Inside-Out Approach

April 16, 2021

1

min read

The Possibilities Are Just Extraordinary

The Possibilities Are Just Extraordinary

April 16, 2021

2

min read

12 Qs with Murat Melek, Design Manager at Walter P Moore

12 Qs with Murat Melek, Design Manager at Walter P Moore

April 16, 2021

3

min read

12 Qs with Megan Miller, ED of Spencer Educational Foundation

12 Qs with Megan Miller, ED of Spencer Educational Foundation

April 16, 2021

4

min read

12 Qs with Mark Cravens, Principal at Cravens Consulting

12 Qs with Mark Cravens, Principal at Cravens Consulting

April 16, 2021

2

min read

12 Qs with Ken Radigan, CEO at PRMIA

12 Qs with Ken Radigan, CEO at PRMIA

April 16, 2021

3

min read

My Business is Digitizing, Why Not My Risk Management Too?

My Business is Digitizing, Why Not My Risk Management Too?

April 16, 2021

1

min read

'Basis Risk’ in the Modeled Vulnerabilities of Customers' Exposures

'Basis Risk’ in the Modeled Vulnerabilities of Customers' Exposures

April 16, 2021

3

min read

It’s Time for Transparency

It’s Time for Transparency

April 16, 2021

1

min read

It’s Now Time for our Data to Catch-up

It’s Now Time for our Data to Catch-up

April 16, 2021

2

min read

12 Qs with Ibbi Almufti, Associate Principal at Arup

12 Qs with Ibbi Almufti, Associate Principal at Arup

April 16, 2021

3

min read

12 Qs with Greg Hendrick, CEO at Vantage Group

12 Qs with Greg Hendrick, CEO at Vantage Group

April 16, 2021

2

min read

Inside Baseball: Lessons for Today’s Risk Managers from a Retired CUO

Inside Baseball: Lessons for Today’s Risk Managers from a Retired CUO

April 16, 2021

2

min read

In Trust We Data

In Trust We Data

April 16, 2021

2

min read

CNA Taps Archipelago for Increased Data Analytics

CNA Taps Archipelago for Increased Data Analytics

April 16, 2021

1

min read

Building a Shared System of Trust

Building a Shared System of Trust

April 16, 2021

2

min read

Best-in-Class Risk Managers are Multilingual

Best-in-Class Risk Managers are Multilingual

April 16, 2021

1

min read

2021: A Year of Digital Convergence for Large Commercial Risks

2021: A Year of Digital Convergence for Large Commercial Risks

April 16, 2021

1

min read

Risk & Insurance: 2020 Trends Set to Shape 2021

Risk & Insurance: 2020 Trends Set to Shape 2021

April 16, 2021

4

min read

12 Qs with Frank Nutter, President of the RAA

12 Qs with Frank Nutter, President of the RAA

March 24, 2021

2

min read

12 Qs with Alexandra Glickman, SMD, Real Estate & Hospitality at Gallagher

12 Qs with Alexandra Glickman, SMD, Real Estate & Hospitality at Gallagher

March 24, 2021

2

min read

Using Data to Unlock a Resiliency Dividend

Using Data to Unlock a Resiliency Dividend

August 06, 2020

4

min read

Two Huge Markets to Benefit from a Digital Transformation

Two Huge Markets to Benefit from a Digital Transformation

August 06, 2020

2

min read

Standing out in the Hardening Market

Standing out in the Hardening Market

August 06, 2020

1

min read

Differentiating Your Portfolio in a Hard Market

Differentiating Your Portfolio in a Hard Market

August 06, 2020

1

min read

Blue Ocean Opportunities

Blue Ocean Opportunities

August 06, 2020

1

min read